Significant growth in TV OTA, TV Digital, and CTV/OTT fueled by political and other local…

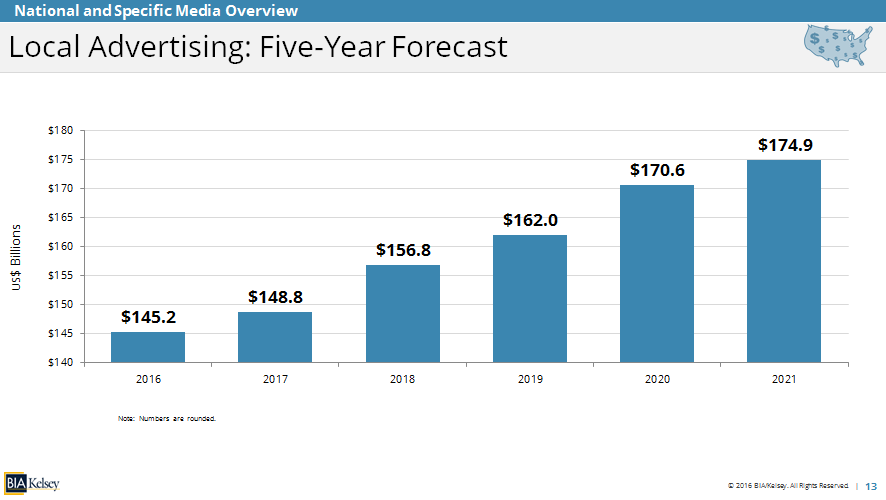

BIA/Kelsey Forecasts Overall U.S. Local Advertising Revenues to Reach $148.8B in 2017, Lifted by Strong Growth in Online/Digital

BIA/Kelsey’s new ad forecast reveals online/digital’s share of the local advertising market will, for the first time, exceed the share of print media by 2018

CHANTILLY, Va. (Oct. 26, 2016) – In its new U.S. Local Advertising Forecast 2017, BIA/Kelsey, the leader in broadcasting and local advertising research and valuations, projects total local advertising revenues in the U.S. to reach $148.8 billion in 2017, up from $145.2 billion this year, representing a growth rate of 2.4 percent. If political advertising was excluded, the growth rate would be 3.9 percent for 2017. BIA/Kelsey defines local advertising as all advertising platforms that provide access to local audiences for national, regional and local marketers.

Faster growth in online/digital advertising revenues is a major component of the projected increases in the overall local advertising pie. BIA/Kelsey estimates online/digital will increase at 13.5 percent, from $44.2 billion in 2016 to $50.2 billion in 2017. That compares with a decrease of 2.4 percent next year for traditional – print and over-the-air – advertising revenues, going from $101.1 billion in 2016 to $98.6 billion in 2017.

“A range of factors will drive local ad revenues higher in 2017 and through the end of the next year,” said Mark Fratrik, SVP and chief economist at BIA/Kelsey. “An improving U.S. economy, increased spending by national brands in local media channels, extraordinary growth in mobile and social advertising, and the continued expansion and selection of online/digital advertising platforms. In fact, we are predicting that online/digital local ad share will exceed the share of print media by 2018.”

Online/digital revenues are generated by online companies that sell locally targeted advertising that includes display, search and classified/vertical advertising. The advertisements are sold by local pure-play online companies, national online companies offering geo-targeted advertising, and local traditional media groups’ online/digital efforts.

The forecast examines the growth and opportunities in the different areas of online/digital:

- Local desktop display (inclusive of video and social) is expected to have a 10.3 percent compound annual growth rate (CAGR), as improved broadband access makes more high quality online streaming and sharing of content easier.

- Local search on desktop devices will grow at a 5.7 percent CAGR. As more search activity takes place on mobile devices, mobile is cannibalizing search dollars from desktop. However, ultimately the local search dollars still go to the same giant players (Google/Bing) that have footholds in both channels.

- Email is expected to grow at a 4.7 percent CAGR, driven by volume increases with consumers choosing to opt in to more lists of their favorite businesses. The mutually beneficial relationship allows consumers to stay informed of the latest offerings and promotions while generating repeat business for firms.

BIA/Kelsey will present findings from the local online/digital segment of the forecast at its upcoming conference, BIA/Kelsey NEXT: The Future of Local Digital Advertising and Marketing, which takes place December 5-7, 2016, in Boston. Visit https://www.bia.com/NEXT2016 for complete conference information, including the agenda, speakers and online registration.

About the BIA/Kelsey U.S. Local Advertising Forecast 2017

The BIA/Kelsey U.S. Local Advertising Forecast 2017 is a five-year forecast that draws from proprietary data; company, industry and country information in the public domain; and discussions with clients and non-clients about the direction and pace of development in the local media marketplace. The forecast is issued annually each fall to preview the upcoming year and is updated in the following spring.

Contents of the forecast include a national overview of total U.S. spending in local markets and a forecast for each individual media breakouts for direct mail, local video, local over-the-air television, local cable television, out-of-home/OOH video, newspaper, online, radio, mobile, directories, social and magazines.

BIA/Kelsey defines local advertising as all advertising platforms that provide access to local audiences for national, regional and local marketers.

Advisory Service clients will receive a copy of the new forecast. To order a copy of the forecast, click to purchase or email sales@biakelsey.com.

For information on gaining access to the forecast by becoming a BIA/Kelsey client, contact Mark Giannini, COO and SVP, business development, at mgiannini@biakelsey.com or (703) 818-2425.

About BIA/Kelsey

BIA/Kelsey (@BIAKelsey) combines data, analytics and insights to provide its clients with the information they need for grounded financial and strategic action. Since 1983, BIA/Kelsey has been a valuable resource for many of the leading companies in media and the financial and legal community serving media and telecom, as well as the FCC and other government agencies. Today, BIA/Kelsey offers a broad range of research, consulting services and conferences to traditional and new media companies. Learn more about BIA/Kelsey at https://www.bia.com.

Media Contacts:

MacKenzie Lovings

(703) 802-2991

mlovings@biakelsey.com

Robert Udowitz

(703) 621-8060

rudowitz@biakelsey.com